Lenders will no longer be able to consider unpaid medical bills as a credit history factor when they evaluate potential borrowers in the U.S. for mortgages, car loans or business loans, according to a rule the Consumer Financial Protection Bureau finalized Tuesday.

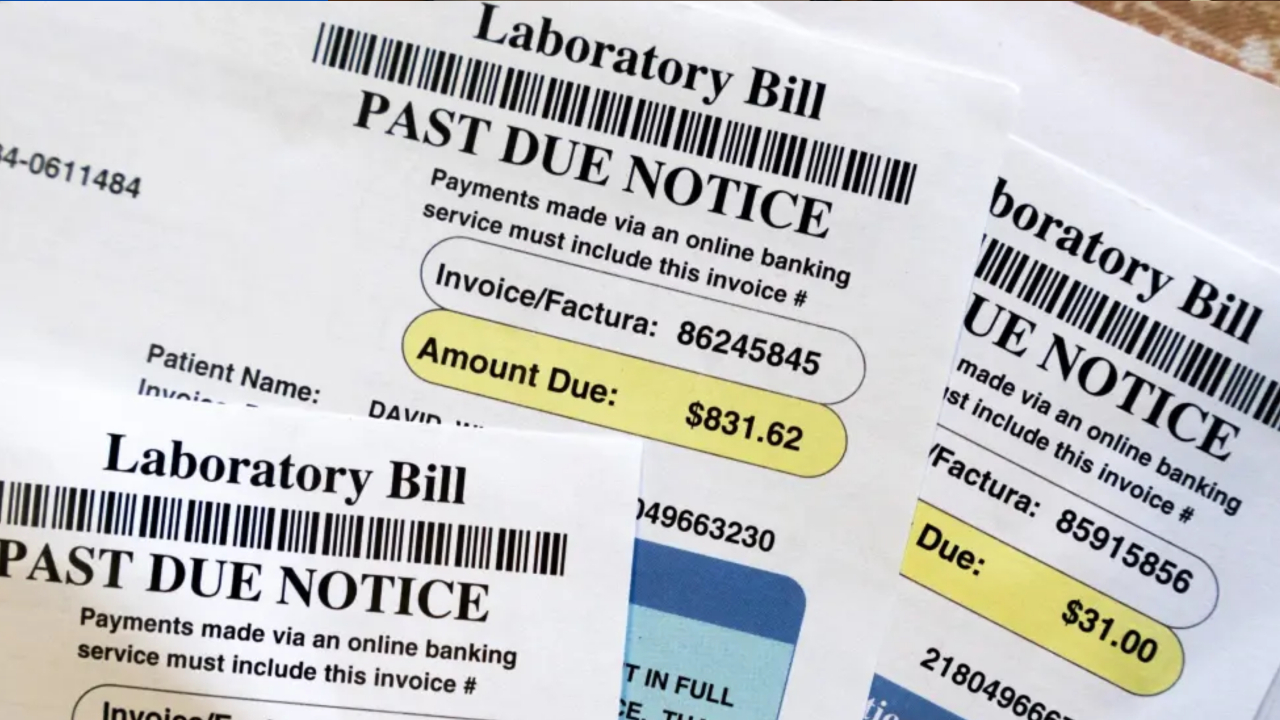

Removing medical debts from consumer credit reports is expected to increase the credit scores of millions of families by an average of 20 points, the bureau said. The CFPB says its research showed that outstanding health care claims are a poor predictor of someone’s ability to repay a loan yet often are used to deny mortgage applications.

The three national credit reporting agencies — Experian, Equifax and TransUnion — said last year that they were removing medical collections under $500 from U.S. consumer credit reports. The government agency’s new rule goes further by banning all outstanding medical bills from appearing on credit reports and prohibiting lenders from using the information.